When it comes to discussing investment strategies and portfolios, most minds shoot right to the glitz, glamour, and high risk-reward commonly associated with stock and equity investments. Although they’re far from unheard of, the humble bond usually takes a backseat to allure of the “golden egg” possibility when investing in stocks, but even though their lower risk-reward may not be quite as enticing to the untrained eye, a good selection of bonds can play an integral part in a successful investment portfolio.

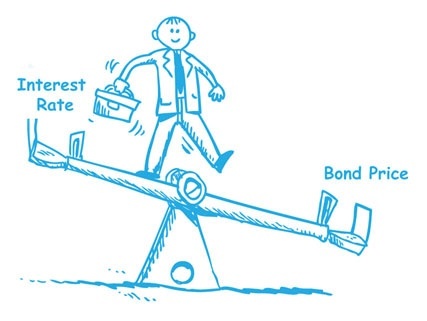

So, yeah, we know we need them, but how exactly do they work? Put simply, the value of a bond after it is purchased shares a negative correlation with the interest rate levels issued by the Federal Reserve. If interest rates rise after your bond is purchased, it is now worth less than face value and will trade at a discount. If interest rates fall then your bond’s value increases, it will trade at a premium. Nothing to crazy right?

Getting into more specifics now, the way in which you purchased the bond matters in terms of how much the value of your purchase fluctuates based on these interest rate changes. For example, if you are a shareholder in a bond fund, a collection of hundreds or even thousands of bonds, your level of boom or bust will be much more dramatic then someone who is an owner of an individual bond. This is because, when interest rates rise or fall, shareholders will either jump off or on the bandwagon, so to speak, of the bond fund according to which way the interest rate turns, causing significant spikes and drop-offs of their investments for those investors who hold onto their shares. Because of their close relationship with interest rates, bonds are also heavily affected by the fear effect, that being when something causes economic fear, whatever it may be, which in turn causes many investors to take their money out of riskier investments (stocks) and gravitate towards safer bets (bonds and securities). This sudden rush of demand drives bond prices up, and, as we know, when bond prices rise their yields fall, causing losses for those already invested in individual bonds and bond fund shareholders.

However, these pains brought about by fear are usually not even close to the hits that one may take in the stock market during a time of economic turmoil. So, in the world of bonds, how does one protect themselves. Firstly, it is always safer to buy bonds with shorter maturities, meaning the issuer will have to pay you back sooner, leaving you less vulnerable to interest rate fluctuations. Second, when investing in individual bonds, make sure you and your adviser have looked over the company’s reliability, particularly in terms of credit, to give yourself the highest chance of obtaining returns. So now we all have some basic knowledge of bond investments, and if any of this sounded good to you, do some research, sit down with us, and find out if bonds or securities are a good fit for your investment portfolio.