(what most people think before reading this)

It is Saturday afternoon, and you and a friend go out for some lunch, followed by some Starbucks to power you through the late afternoon shopping trip you had planned. Following all that walking around, you and your friend decide on sitting down for dinner before going to the movies to see the latest Christopher Nolan film. Walking out of the theater, nearly 73 out of 100 Americans could not tell me what they spent that day, nor how it affected their budget. Where did that number come from? That number is the percentage of people in America that do not have a budget.

A whopping 27% of people do not believe that they need to have and follow a budget! Another 24% do not think they would be able to stick to one, while 10% simply do not feel like making one. After digesting these figures, it is no wonder why 70% of the country feels stressed about their personal finance situation. A budget is a powerful tool that can help families track their spending and know where their money is going. In addition to improved tracking, a budget is the best way to measures cash flow for your household. Cashflow is the inflow and outflow of money, and knowing how much is coming in and out each month will allow you to set achievable goals to reach your desired financial future.

The 4 Step Budget

It is important to note that everybody’s budget will look different depending on needs, location, income, family health, and a variety of other factors. Your budget should be unique to you. There is no golden rule to a budget, although many “gurus” will try to tell you otherwise. Before you begin, think about how much you want to be spending, and what the maximum you are willing to spend is.

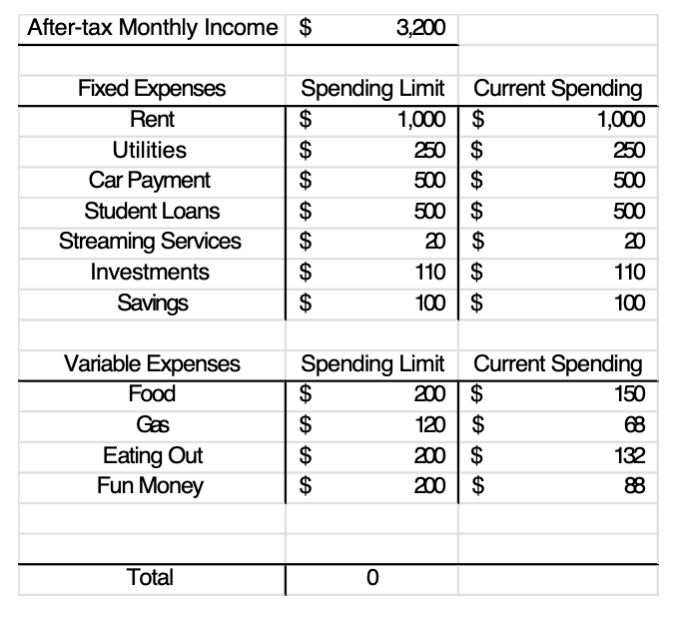

- Once you are ready to begin, the first thing to do is input your after-tax monthly income at the top of the page, and begin to work down.

- Next, list off all of your fixed expenses with the corresponding amount next to each category. Fixed expenses include things like rent, electricity, car payments, loans, etc.

- Then, list out all of your variable expenses, or expenses that change month to month. This could be food, gas, eating out money, anything that changes cost wise month to month, and put a limit next to each category.

- Finally, make sure to subtract your after-tax monthly income by your fixed and variable expenses, and that number should equal zero. (I have provided an example below) This is a common strategy called budgeting to zero, which suggests that everyone should budget down to zero so you know exactly how much money is going where.

Mind, Budget, and Spirit

Maintaining the budget every month is normally the most challenging part for people, but a budget will only give what you put into it. Taking 15 minutes a week to update your monthly budget is a small price to pay for financial clarity. One helpful tip is to use the same card or bank for all your fixed expenses (or do as much as you can) and all your variable expenses on a different card or bank. This way, when you go to track your spending, you know where to look for which purchases.

If budgeting were easy, everyone would do it! It will take work, a little bit of time, and most importantly of all, consistency. By staying committed and being aware of your spending, your path to financial success increases in likelihood and clarity.

Disclosure:

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own.

Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

These materials contain references to hypothetical scenarios. They are presented for the purpose of demonstrating a concept or idea, and not intended to be interpreted as representing any specific person. Such representations are not intended to substitute for individual investment advice, even if the scenario appears to have similar characteristics.